WE HELP EUROPEAN COMPANIES CUT FOREIGN EXCHANGE COSTS

BY PROVIDING BETTER FX RATES THAN BANKS

- Our customers cut hidden FX costs typically by tens or hundreds of thousands of euros annually

- Our proven services are widely used by exporters and importers across Europe

- Our customers’ legal counterparty for our EU regulated secure services is Currencycloud that was acquired by Visa

- We are a Nordic fintech company that serves European companies with annual FX volumes of at least 5 million euros

Benefits

Our customers cut hidden FX costs typically by tens or hundreds of thousands of euros annually

Cut FX conversion costs significantly

Cut foreign currency payments related hidden FX costs, because our competitive FX conversion rates are often much better compared to banks

Hedge FX risks cost

effectively

Cut FX hedging related hidden FX costs, because our competitive FX forward rates are often much better compared to banks

Continue to automate payments processes with your bank

Continue to use your existing bank’s payments services to initiate and reconcile payments automatically in your financial systems

Start using our services without any IT work

Starting to use our services requires no IT work, because you may continue to use your existing bank provided integrations to your financial systems

Get first class

customer service

You have a dedicated contact person, who has in-depth understanding of your needs and provides customer service in English, Danish or Finnish

Use our EU regulated services securely

Our customers’ legal counterparty for our EU regulated secure services is Currencycloud that was acquired by Visa

Customers

Our proven services are widely used by exporters and importers across Europe

Security

Our customers’ legal counterparty for our EU regulated services is Currencycloud that was acquired by Visa

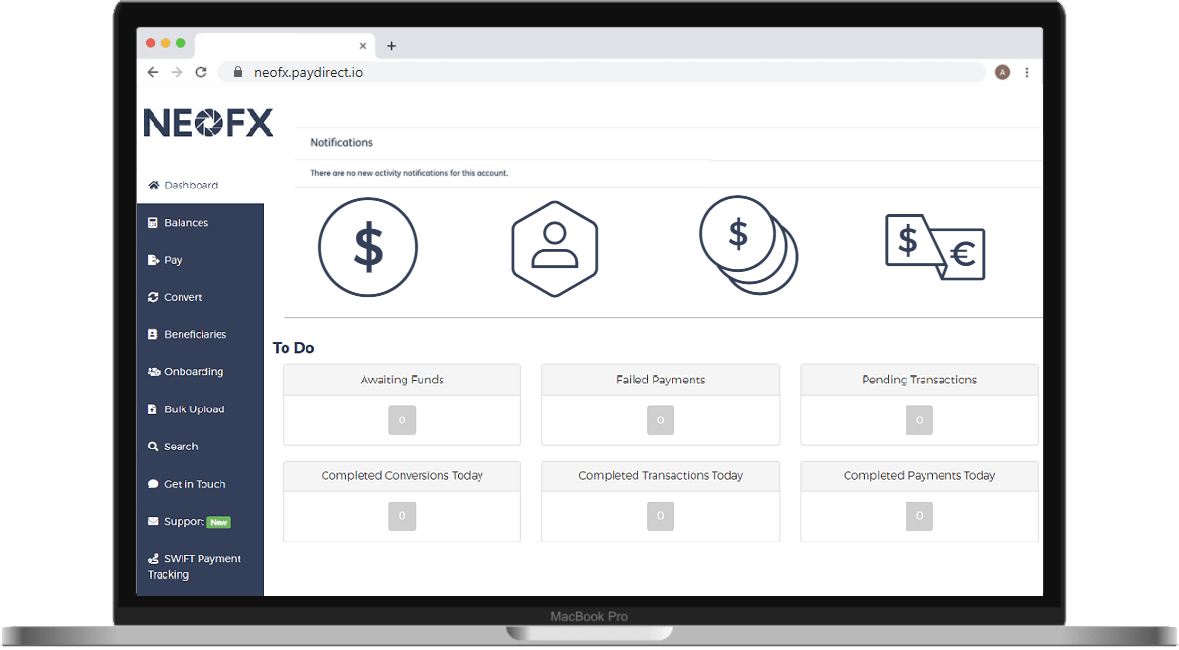

Currencycloud

Currencycloud B.V. was acquired by Visa Inc. (US Company ID 26-0267673), which is world’s leader in digital payments

De Nederlandsche Bank

Currencycloud B.V. is licensed by De Nederlandsche Bank as an Electronic Money Institution (Financial Services Register Number R142701)